Mastering Accounts Receivable: Strategies for Enhancing Your Business Cash Flow

Accounts receivable (AR) represents money owed to a company by its customers for goods or services already delivered but not yet paid for. Effectively managing AR is crucial for maintaining healthy cash flow and operational stability. This financial metric is a key component of a company’s balance sheet, influencing both short-term financial planning and long-term business strategy. For a more in-depth exploration of accounts receivable, including definitions, management tips, and its impact on business, visit Investopedia.

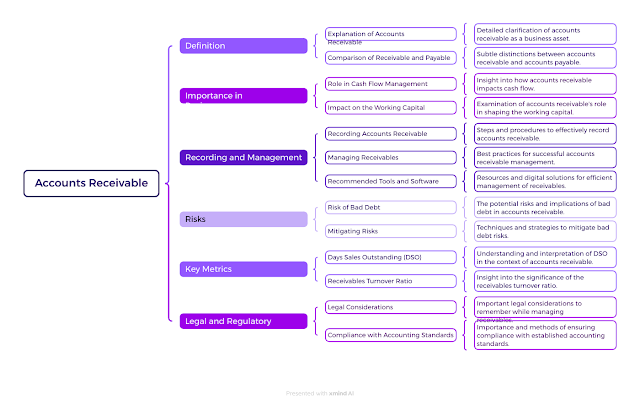

Definition

Explanation of accounts receivable as an asset.

Distinction between accounts receivable and accounts payable.

Importance in Business

Role in cash flow management.

Impact on the working capital.

Recording and Management

How to record accounts receivable.

Best practices for managing receivables.

Tools and software recommended.

Risks

Risk of bad debt.

Techniques to mitigate these risks.

Key Metrics

Days Sales Outstanding (DSO).

Receivables Turnover Ratio.

Legal and Regulatory

Legal considerations in managing receivables.

Compliance with accounting standards.

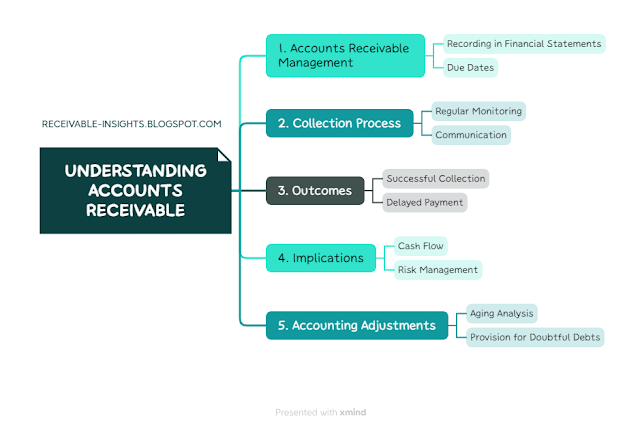

This mind map could serve as a guide to understanding the complexity and significance of managing accounts receivable in a business context.

Comments

Post a Comment