Understanding Accounts Receivable: How Unpaid Deliveries Impact Company Liquidity and Financial Health

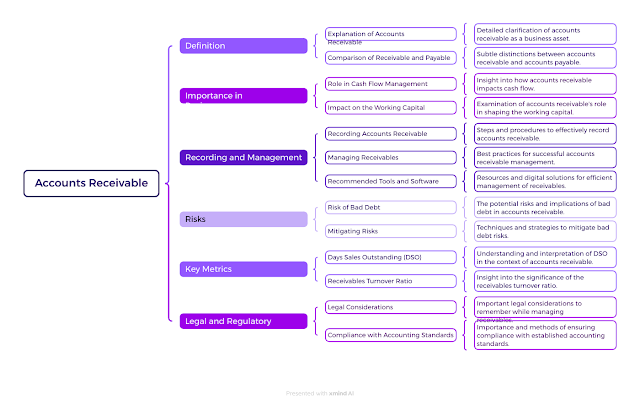

Accounts receivable refers to the money owed to a company by its clients or customers for goods or services that have been delivered but not yet paid for. It is recorded as an asset on the company's balance sheet because these are funds expected to be received in the future.

Accounts receivable typically arise in companies that offer their goods or services on credit, meaning they allow payment to be made after the delivery of goods or completion of services. Managing accounts receivable is important for maintaining liquidity and the financial health of a company, as long-term or uncollectible debts can negatively impact its financial results.

Practical Example

Scenario:

Imagine a company, Bright2Tech Solutions, that specializes in providing software development services. Bright2Tech offers its services on credit to its clients, allowing them to pay within 30 days of invoice issuance.

Situation:

- In January 2024, Bright2Tech completed a project for a client, Inc2Class Inc., and issued an invoice for $50,000 on January 15th.

- On January 20th, Bright2Tech completed another project for a different client, Tech2Advance, and invoiced them for $30,000.

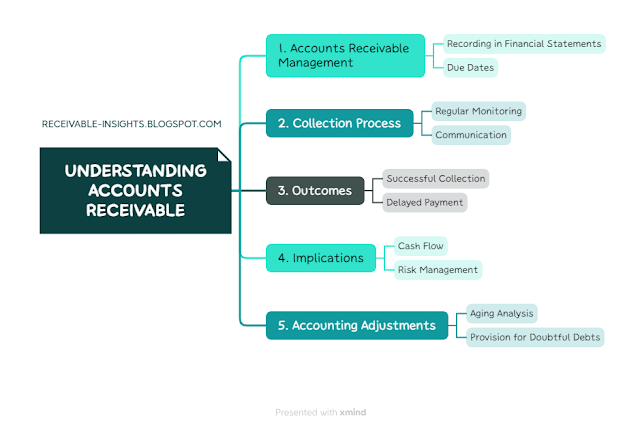

Accounts Receivable Management:

- Recording in Financial Statements: Bright2Tech records these amounts as accounts receivable in its balance sheet, anticipating that these funds ($80,000 in total) will be received in the near future.

- Due Dates: The invoice for Innovate Inc. is due on February 14th, and the one for TechA2dvance is due on February 19th.

Collection Process:

- Regular Monitoring: Bright2Tech's finance team regularly monitors the status of these invoices.

- Communication: As the due dates approach, the team sends polite reminders to both clients.

Outcomes:

- Successful Collection: Inc2Class Inc. makes the payment on February 10th. Bright2Tech updates its records, reducing the accounts receivable by $50,000.

- Delayed Payment: Tech2Advance, however, requests an extension due to cash flow issues, promising to pay by the end of March.

Implications:

- Cash Flow: The delay in receiving payment from Tech2Advance affects Bright2Tech's cash flow planning. The finance team needs to adjust their forecasts and may need to delay some of their own payments or draw on a line of credit to cover short-term expenses.

- Risk Management: Bright2Tech reviews its credit policy and considers tightening credit terms for future projects or conducting more thorough credit checks on new clients.

Accounting Adjustments:

- Aging Analysis: Bright2Tech performs an aging analysis of its accounts receivable at the end of February. The $30,000 from Tech2Advance is now in a different aging category.

- Provision for Doubtful Debts: If Tech2Advance’s financial situation seems risky, Bright2Tech might need to create a provision for doubtful debts, impacting its financial results.

In this example, Bright2Tech's experience with accounts receivable showcases the typical process of recording, monitoring, and managing credit sales, and the implications of delayed payments on a company's financial health and cash flow management.

Please note that all company names, systems, and other specific references mentioned in the previous text, such as Bright2Tech Solutions, Inc2Class Inc., and Tech2Advance, are entirely fictional. Any resemblance to real companies, systems, or entities is purely coincidental and does not imply any form of real-world connection or responsibility.

Comments

Post a Comment